In the realm of investment strategies, silver stacking stands as a time-tested method for safeguarding wealth and diversifying portfolios. As economic uncertainties loom and traditional investment avenues fluctuate, the allure of precious metals, particularly silver, remains steadfast. In this comprehensive guide, we unravel the intricacies of silver stacking, exploring its rationale, methods, considerations, and the rationale behind it.

Understanding the Essence of Silver Stacking

What is the point of stacking silver?

Silver stacking transcends mere accumulation; it embodies a strategic approach to wealth preservation. Unlike fiat currencies vulnerable to inflationary pressures, silver retains its intrinsic value over time. As a tangible asset, it serves as a hedge against economic downturns and currency devaluations, offering stability amidst financial turbulence.

Is it better to stack silver bars or coins?

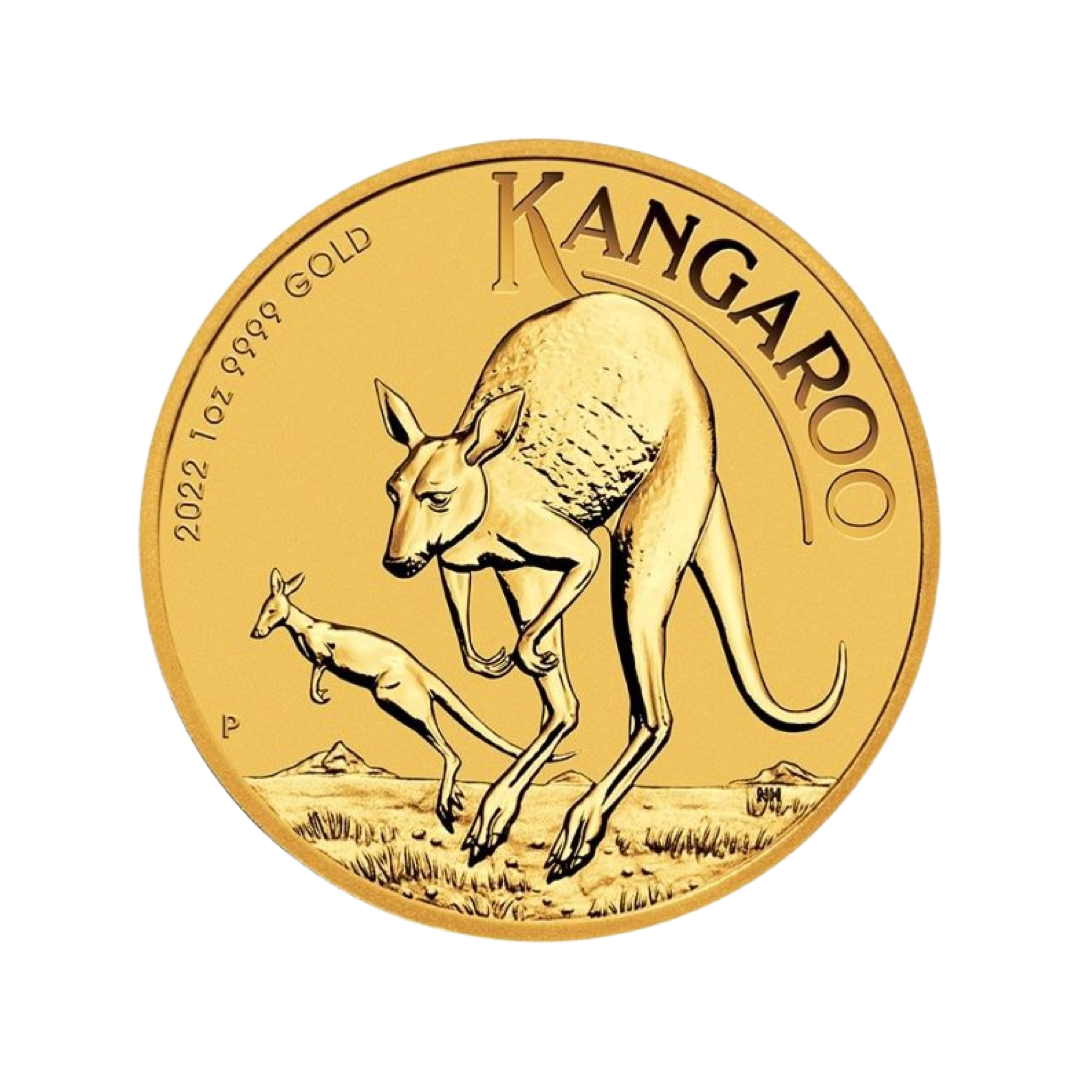

The choice between silver bars and coins hinges on individual preferences and investment objectives. While silver bars offer cost-effective bulk purchasing, silver coins present advantages in terms of liquidity and divisibility. Ultimately, the decision boils down to personal investment strategies and risk appetites.

Navigating the Silver Stacking Landscape

As prospective silver stackers embark on their investment journey, myriad questions arise, chief among them being, "How much silver should I stack?" and "Should you stock up on silver?"

How much silver should I stack?

Determining the ideal quantity of silver to stack entails a delicate balance between financial capabilities and investment goals. While some advocate for allocating a certain percentage of one's portfolio to silver, others adopt a more conservative approach, gradually accumulating silver over time. As a rule of thumb, diversification remains paramount, with silver constituting a prudent component of a well-rounded investment portfolio.

Should you stock up on silver?

In an era fraught with economic uncertainties and geopolitical tensions, the case for stocking up on silver resonates with discerning investors. Silver's intrinsic value, coupled with its historical role as a store of wealth, underscores its relevance in modern investment strategies. By fortifying portfolios with silver holdings, investors bolster their financial resilience and mitigate the risks associated with market volatilities.

Partnering with Trusted Sources: Localcoincompany & Tualatin Valley Gold & Silver

In the quest for reputable sources of silver, discerning investors turn to industry stalwarts such as Localcoincompany and Tualatin Valley Gold & Silver.

At Localcoincompany, a commitment to transparency and integrity underscores every transaction. With a diverse array of silver products and competitive pricing, Localcoincompany empowers investors to navigate the intricacies of the precious metals market with confidence.

Similarly, Tualatin Valley Gold & Silver stands as a beacon of reliability and professionalism in the precious metals industry. Boasting a sterling reputation for customer satisfaction and product quality, Tualatin Valley Gold & Silver offers a seamless silver stacking experience tailored to meet the unique needs of investors.

In conclusion, the decision to embark on a silver stacking journey transcends mere financial prudence; it embodies a steadfast commitment to safeguarding one's wealth and securing a prosperous future. As economic landscapes evolve and uncertainties persist, silver emerges as a beacon of stability and resilience, beckoning investors to embark on a journey of wealth preservation and financial empowerment. Whether through silver bars or coins, the principles of silver stacking endure, offering a timeless testament to the enduring allure of precious metals in the annals of investment lore.